California Proposition 19

On November 3, 2020, California voters approved Proposition 19, the Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act. Proposition 19 is a California constitutional amendment that limits people who inherit family properties from keeping the low property tax base unless they use the home as their primary residence.

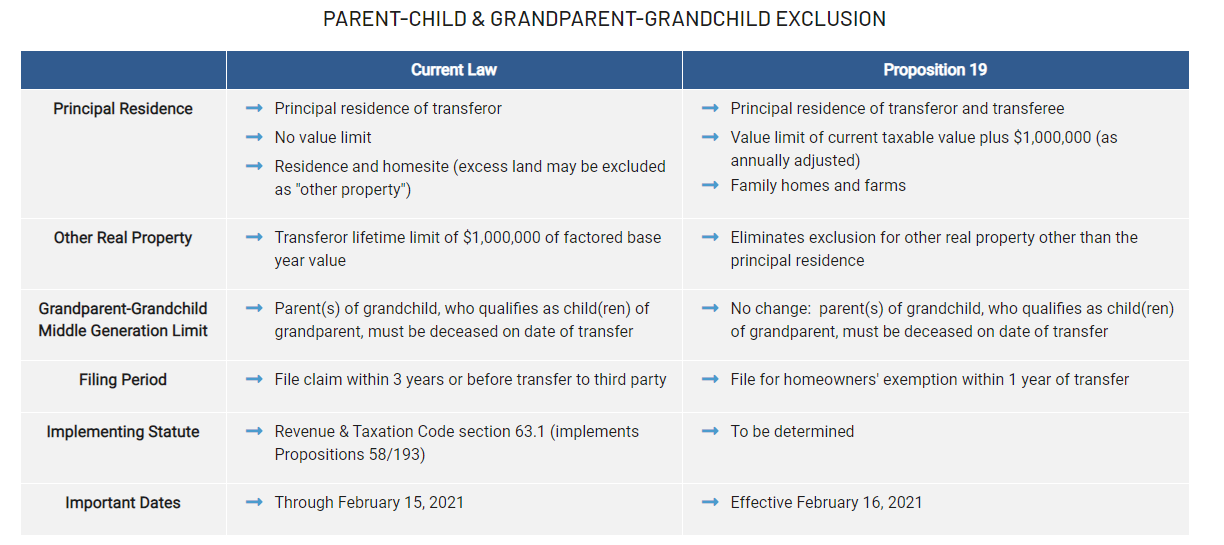

This new proposition will make important changes to existing statewide property tax saving programs for Californians. California Proposition 19 replaces California Proposition 58(1986) and Proposition 193(1996) by limiting parent-and-child transfer and grandparent-to-grandchild transfer exclusions. These Prop 19 changes are likely to go into effect on 2/16/2021. As of right now, the California Board of Equalization is still trying to work out some of the formalities of the new legislation. You can view the Board of Equalization current interpretation of California Proposition 19 here.

Here are the impacts made to Proposition 58 by Proposition 19 as expressed on the California BOE website:

California Proposition 19 changes to Proposition 58

California Proposition 19 changes to Proposition 58

The two most significant changes made to Proposition 58 by California Proposition 19 are the restriction to occupancy and the new $1,000,000 benefit limit on a primary home. Even once these changes to Prop 58 are in place, there are still significant benefits available to California residents who inherit a home from a parent. Providing you intend to occupy the home as your primary residence so can still save as much as $10,000 annually in property tax savings.

If you, a family member or client has questions on California Proposition 19, or would like a free benefit analysis on how much you may be able to save by taking advantage of a parent to child property tax transfer, please call us at 877-464-1066.